On September 6. Geveran sold 7,44 million FLNG shares to “family” members in a TRS agreement that expires December 6. 2018 .

Betting on behalf of his family that share price will go up, the family members already have millions in unrealized gains. The TRS was bought at 12,15 kroner meaning that gains above this price is now substantial.

The questions investors should ask are:

- Will Fredriksen prolong this TRS and reap dividend benefits next year as well as the actual share gains?

- How far will he pump up the share price for the benefit of his family?

- When will he return the swap, and at what price?

Given the huge amount of shares it is likely to think he wants big rewards, if so, how many kroner up? Will it go even beyond the consensus of brokers?

For now we know market will be very strong, it might even go ATH and Fredriksen has the best setting to make this yet another successful story in shipping.

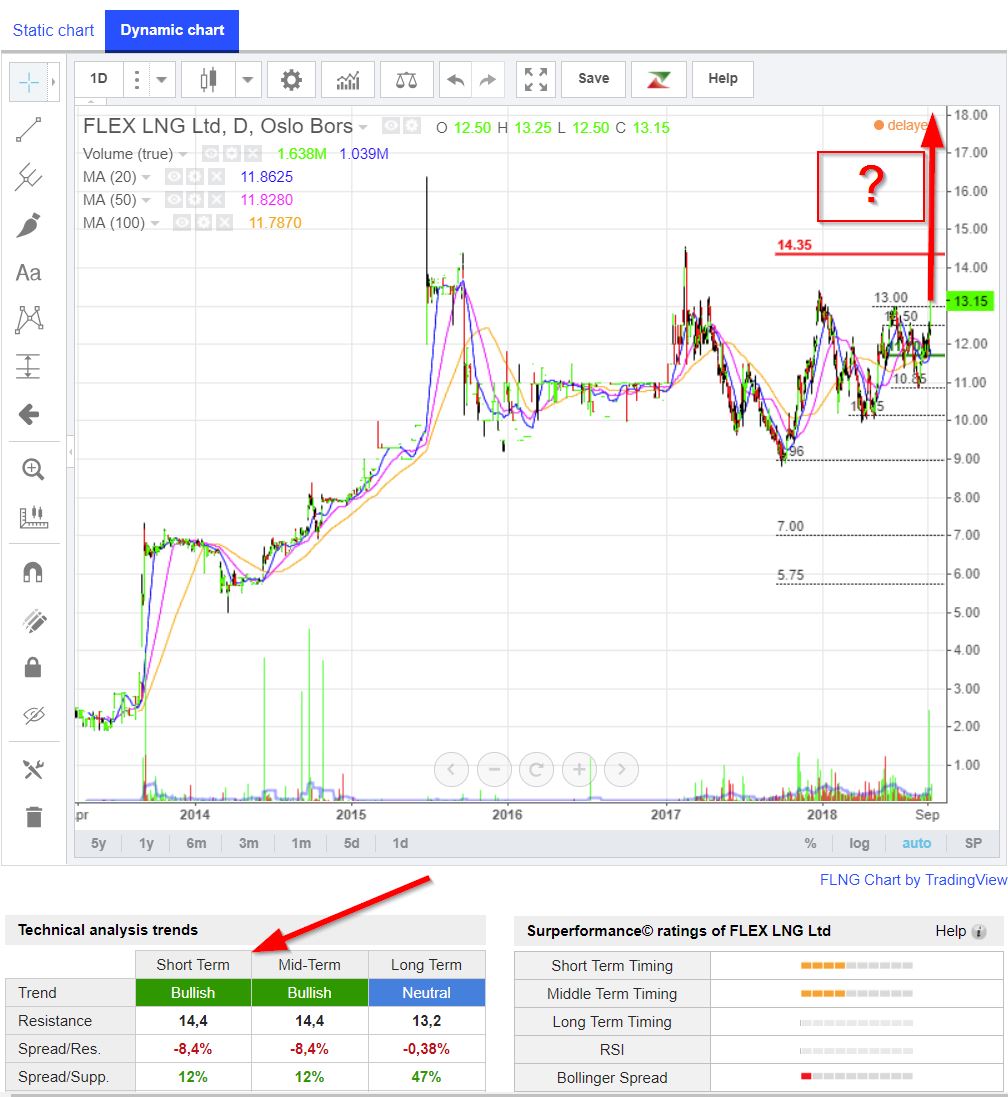

Technical analysis is pointing straight up and next resistance level is around 14,50 kroner, this one I expect will be very weak and new highs might come after this.

You must be logged in to post a comment.